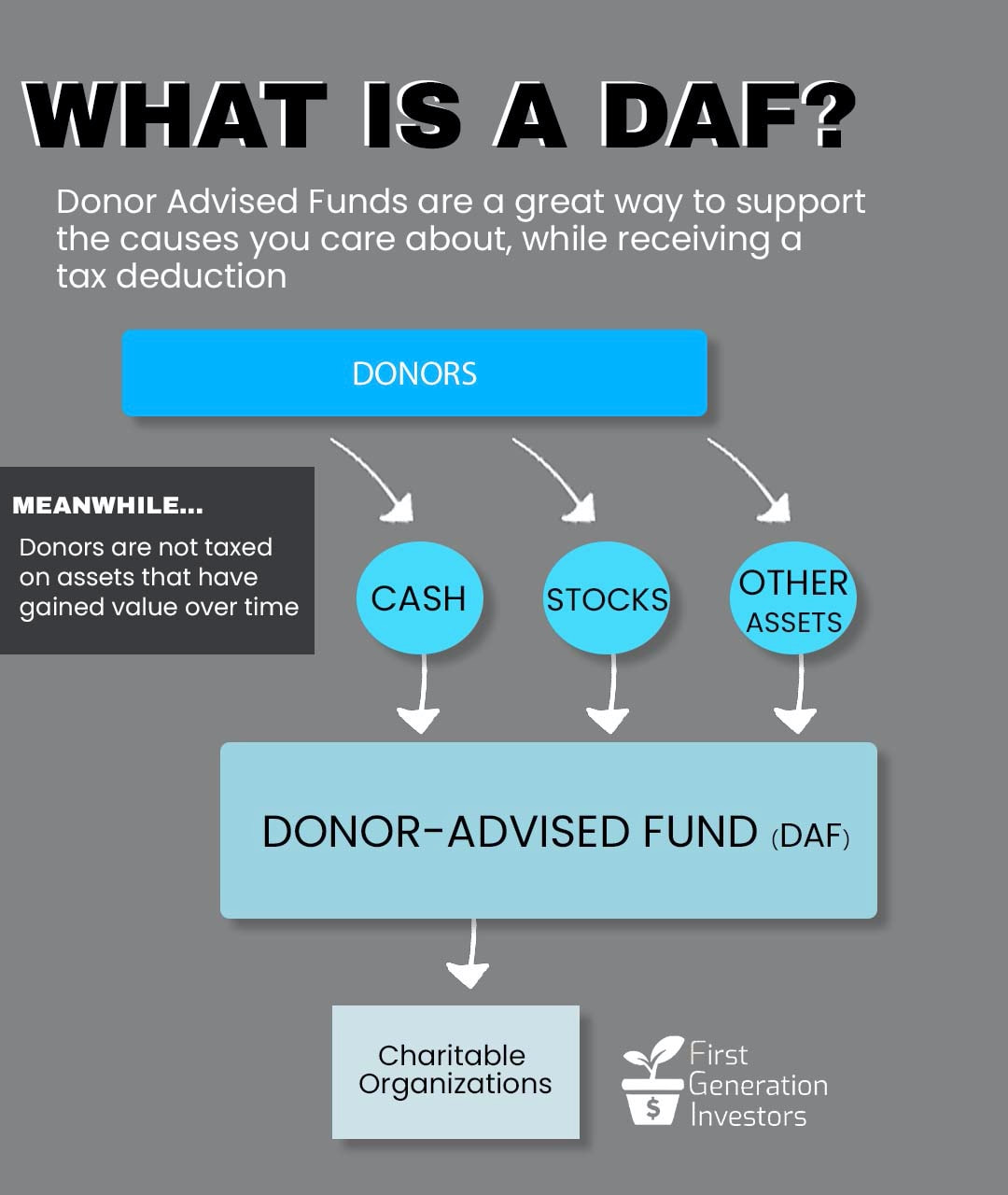

Donor-Advised Funds: What are they, and how can I use one to support First Generation Investors?9/30/2020 What Is a Donor-Advised Fund? A Donor-Advised Fund (DAF) is a centralized charitable organization that permits you, the donor, to: 1.... What Is a Donor-Advised Fund?

A Donor-Advised Fund (DAF) is a centralized charitable organization that permits you, the donor, to: 1. Give charitably. 2. Immediately receive a tax deduction. 3. Recommend grants from the fund to your preferred charities over an extended period of time. If you donate appreciated assets––like stocks whose value have increased––into the DAF, you can avoid having to pay taxes on the increases, while the charity gets the full benefit of the appreciated assets. Plus, during the time that the funds are invested in the DAF, they are likely to grow, and you won’t need to pay taxes on that appreciation either. Appreciated Asset Example You invest $100 in ABC stock. Over time, it grows to be worth $500. If you sold it, you’d owe taxes on the $400 gain, and you would have far less than $500 to share. However, if you donate the appreciated stock to a DAF, you get to deduct the $500 donation from your taxes immediately. Then, if the value of the shares grows from $500 to $550 while in the DAF account, you can grant the $550 from the DAF to your favorite nonprofit, which will reap the full benefit! Monetary Example You have $5,000 that you want to donate, and you know that doing so will deduct that amount from your taxes, but you don’t know exactly where you want to donate the $5,000. You can donate the money to a DAF, which will invest it for you, allow you to take the $5,000 tax deduction immediately, and help you give out that $5,000+appreciation (tax-free) over time. DAFs can also assist you in discovering qualified organizations to which to give! Using a DAF to Support FGI First Generation Investors is a 501(c)(3) charitable organization, and a number of generous donors have already used DAFs to help fund the program, enabling us to teach underserved high school students the power of investing and give them real money to invest. If you or someone you know would like to use a DAF to make a donation, our EIN is 84-3859483. Want to learn more about DAFs? Email [email protected], and make the subject line "Tell me more about DAFs." We’re always happy to hear from you!

0 Comments

Leave a Reply. |

|